Who needs a CHAR410 Form?

CHAR410 is a Registration Statement for Charitable Organizations, which is filed for the initial charitable organization’s registration.

What is the Registration Statement for Charitable Organizations Form for?

Form CHAR410 serves as a one-time registration statement. Based upon the information given in the fillable CHAR410 form, the Charities Bureau should designate a registration number and identify a type of the charity.

Is CHAR410 Form accompanied by other forms?

The organization submitting the document should provide several attachments, they are:

- Incorporation certificate, trust agreement or other organizing document accompanied by any amendments

- Bylaws, or other internal rules,

- IRS Form 1023 or 1024 Application (if applicable)

- IRS tax exemption determination letter (if applicable).

When is CHAR410 Form due?

Submission of the CHAR410 and all attachments does have certain deadlines. However, they can vary according to their applicability to a particular case. Therefore, they are as follows:

1. The CHAR410 should be filed 30 days before to solicitation of donations from the state of New York (its residents, foundations, corporations, government agencies, etc.), or

2. The form can be submitted six months after the organization has received property or income planned for charitable purposes in New York State.

In case both deadlines can be applied, the Registration Statement is due by the earlier option.

How do I fill out the CHAR410 fillable Form?

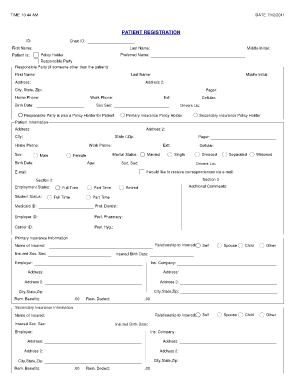

The completed form should furnish information on the following:

- Identification of registrant

- Certification

- Submission of fees

- Documents attached

- Structure of the organization

- Activities

- Federal Tax Exempt Status

Where do I send CHAR410 Form?

Once completed and signed, Registration Statement for Charitable Organizations Form should be directed to the address indicated at the top of the blank, which is New York State Department of Law, Charities Bureau — Registration Section.